iowa capital gains tax calculator

Filing Status 0 Rate 15 Rate 20 Rate. Your household income location filing status and number of personal.

Capital Gains Yield Cgy Formula Calculation Example And Guide

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

. Our income tax calculator calculates your federal state and local taxes based on several key inputs. See Tax Case Study. The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form.

The Iowa capital gain deduction is subject to review by the Iowa Department of. Washington taxes the capital gains income of high-earners. When a landowner dies the basis is automatically reset.

Includes short and long-term Federal and. Browse them all here. Chat with a Business Tax Advisor Now.

Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. Many of Iowas 327 school. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Capital Gains Tax Calculator. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Additional State Capital Gains Tax Information for Iowa.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Line 23 can be more than the net total reported on Schedule D. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status.

Some or all net capital gain may be taxed at 0 if your taxable income is less than 80000. Skip to main content. The 15 rate applies to individual earners between 40401 and.

Our capital gains tax calculator can provide your tax rate for capital gains. The document has moved here. Find Reliable Business Tax Info Online in Minutes.

The cutoff for not owing any capital gains tax is now 40400 for individuals and 80800 for married couples filing jointly. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Enter your Gross Salary and click Calculate to see how much Tax youll need to Pay.

The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high. Talk to Certified Business Tax Experts Online. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

IA 100A - IA 100F Capital Gain. Capital gains taxes on assets held for a year or less correspond to. Long-Term Capital Gains Tax Rates.

Unrelated losses are not to be included in the. The tax rate on most net capital gain is no higher than 15 for most individuals. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

The Combined Rate accounts for Federal State. The calculator on this page is designed to help you estimate your. Ad 247 Access to Reliable Income Tax Info.

Introduction to Capital Gain Flowcharts. Iowa Income Tax Salary Calculator. Get Access to the Largest Online Library of Legal Forms for Any State.

This is a deduction of qualifying net capital gain realized in 2020. Easily E-File to Claim Your Max Refund Guaranteed. For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction.

The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction. If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa capital gain deduction. New Hampshire doesnt tax income but does tax dividends and interest.

Ad The Leading Online Publisher of National and State-specific Legal Documents. 529 Plans by State. Iowa state income tax rates range from 0 to 853.

Calculate Your 2022 Tax Return 100. All publicly distributed Iowa tax forms can be found on the Iowa Department of Revenues tax form index site. Iowa allows taxpayers to deduct federal income taxes from their state taxable income.

Learn about Iowa rates for income property sales taxes and more to estimate what you will pay.

Capital Gains Tax Calculator 2022 Casaplorer

2022 Capital Gains Tax Rates By State Smartasset

Find Out How Much House You Can Realistically Afford With Nerdwallet S Home Afford Mortgage Refinance Calculator Refinance Mortgage Mortgage Payment Calculator

Calculate Capital Gains Tax Capital Gains Tax Calculator

Should You Move To A State With No Income Tax Forbes Advisor

What Makes A Best In Class Email Marketer These Six Things Capital Gains Tax Capital Gain Life Insurance Policy

How To Calculate Capital Gains Tax H R Block

Georgia Retirement Tax Friendliness Retirement Calculator Financial Advisors Retirement

2022 Capital Gains Tax Rates By State Smartasset

Short Term Long Term Capital Gains Tax Calculator Taxact Blog

Income Tax Calculation Fy 2019 20 Salaried Employees Standard Deduction Rebate U S 87a Cess Youtube Standard Deduction Income Tax Income

Income Tax Calculator 2021 2022 Estimate Return Refund

Capital Gains Tax Calculator Capital Gains Tax Calculator Exchangeright

How To Calculate Net Operating Loss A Step By Step Guide

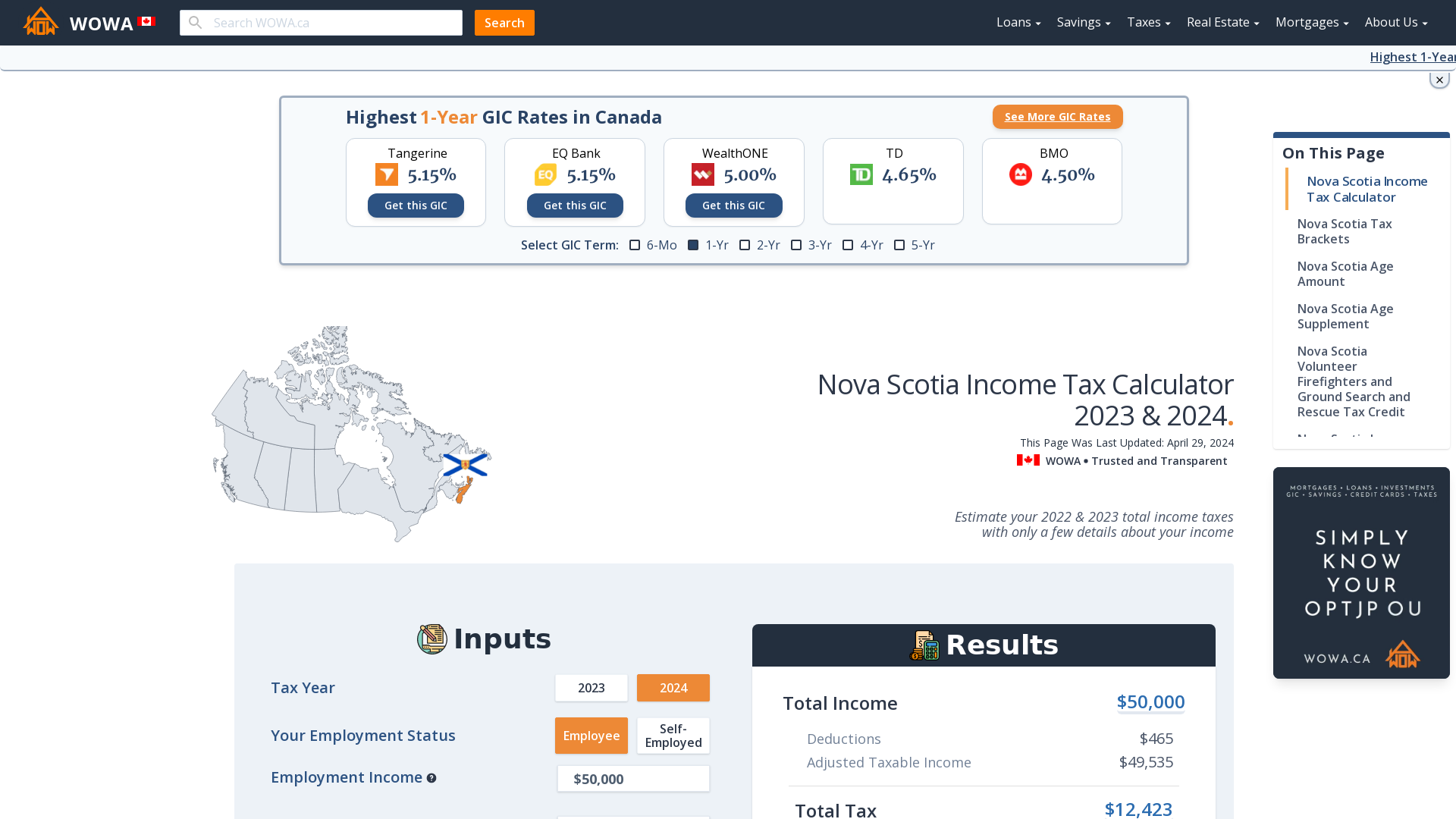

Nova Scotia Income Tax Calculator Wowa Ca

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified